By: Justin B. Weiss and Nigel Cory

Qatar has set the ambitious goal of becoming a leading digital hub in the Middle East. CGA (Nigel Cory and Justin Weiss) recently had the opportunity to engage with local stakeholders to gain deeper insights into Qatar’s digital and technological aspirations. .

Qatar has laid much of the foundations and scaffolding for its digital ambitions: it has a national plan (vision 2030), a cloud first strategy, a national AI strategy, a national cyber security strategy; it has created several new agencies and committees, such as the National Cyber Security Agency; its digital connectivity is among the best in the world; and it has made investments and partnerships with key digital services and infrastructure providers, such as Microsoft, OpenAI, Ooredoo and Nvidia, and Scale AI. The recent visit by U.S. President Trump perhaps marks an inflection point, given it led to over $200 billion in announcements. It also energized Qatar’s tech ambitions and drew significant attention from other U.S. firms, signaling potential for increased collaboration and growth.

On artificial intelligence (AI), Qatar is moving ahead with AI investments and partnerships without having yet developed AI specific laws, regulations, or guidelines. A recent (March 2025) IMF assessment on AI in Qatar stated that “Qatar’s AI exposure has increased significantly over the years, and increasing AI adoption is assessed to yield more opportunities than risks for the country’s labor force, thanks to the private sector’s contribution in increasing jobs that are more likely to benefit from AI-driven productivity gains.” A 2023 McKinsey survey shows that Qatar and its Gulf Cooperative Council (GCC) neighbors are ready users of AI—62 percent of respondents reported using AI in at least one business function in their organization. While Saudia Arabia and the United Arab Emirates are the only two GCC members with AI supercomputers, Qatar’s recent investments and partnership announcements points towards developing or acquiring them in the future.

In 2019, Qatar was early in launching its first National AI strategy, which focused on six key sectors: education, data access, employment, business, research, and ethics. Shortly after, in 2021, it formed the high-level AI Committee to coordinate action across the government. The key challenge for Qatar on AI is turning these high-level plans into tangible and coordinated action across respective government agencies. As in all jurisdictions, the plan also implicates a commitment to further upskilling – a push for improved technology literacy across the public and private sectors alike.

Qatar, like many countries, recognizes the need to train and empower more mid- and working-level officials in AI, cloud, data, privacy, cybersecurity, and other digital technology issues. Qatar’s early and well-organized approach to AI, for example, means that ministers and senior leaders understand the vision and objective, but without a growing cadre of AI experts across Qatar’s government, it’ll be difficult to turn its strategies into action in the various ministries. More broadly, as the IMF recommends, government could enhance digital skills of the labor force through targeted upskilling and reskilling programs and digital talent attraction schemes for expatriate workers.

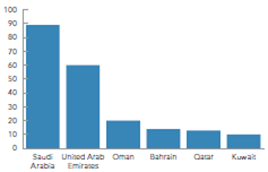

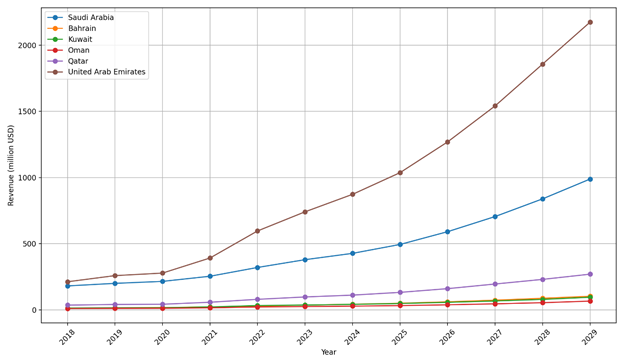

On cloud, Qatar has the foundation to create a supportive framework for this critical digital service. Qatar’s data center and cloud market is growing but must grow a lot more to catch up to regional neighbors Saudi Arabia and the United Arab Emirates (see figures 1 and 2).

Figure 1: Number of Data Centers in GCC Countries (as of April 2024).

Figure 2: SaaS Revenue in Gulf Countries (2018-2029 (forecasted))

Qatar’s 2022 cloud policy framework addresses well-recognized issues including the core principles of trust, security, and transparency. Qatar pursues public-private partnerships as it operationalizes rules and regulations around elements of its cloud policy framework. It rightly recognizes that public-private stakeholders have shared responsibilities for cloud and data security. However, like other countries, the challenge for Qatar and cloud firms is getting respective Qatari government agencies to implement the various common elements in a coordinated manner, such as on data classification. A good example of this is the Qatar’s National Cyber Security Agency’s national data classification policy to facilitate the exchange of information throughout the country and to ensure the security of such data.

Many countries pursuing data classification frameworks run into a problem, in that data classification frameworks help develop a risk-based approach to managing data, but they often lead to technical and legal complexity as different government agencies enact different frameworks. Qatar may look to use best practice examples from other countries to help ensure each agency takes a consistent and tailored approach to data and cloud management regulations.

On quantum, Qatar clearly sees it as a strategic technology that it’s willing to invest a lot of resources and effort in. Qatar funded the creation of the Qatar Center for Quantum Computing (QC2) within Hamad Bin Khalifa University (HBKU). As part of President Trump’s visit, it was announced that Invest Qatar (the Investment Promotion Agency of Qatar) signed a strategic agreement with the U.S. firm Quantinuum, a world leader in quantum computing and the developer of the world’s highest-performing quantum computer. The partnership envisions launching joint research projects with Qatari academic and research institutions, exploring opportunities for local integration of quantum technologies and facilitating access to Quantinuum’s cutting-edge quantum computing infrastructure. Qatar has also invested in the French/American quantum firm Alive and Bo, who plan to build the world’s first useful quantum computer.

This is an impressive start for Qatar’s quantum ambitions. However, it’s early days for both the technology and Qatar’s role in it. To ensure success, Qatar would benefit from a targeted supporting strategy. Qatar should identify what niche technological capabilities its firms will target and help build a support structure around these applications. Thus far, Qatar seems to be focusing on quantum communications and sensing. For example, Ooredoo (Qatar’s leading telecommunications operator) is collaborating with the Qatar Centre for Quantum Computing to establish Qatar’s first quantum communication testbed. Qatar quantum stakeholders will benefit from forward leaning and proactive engagement internationally to find a role in emerging networks and programs that test, benchmark, and apply quantum technologies. For example, it may consider the U.S. Defense Advanced Research Projects Agency (DARPA)’s international program to help companies target industrially useful quantum applications.

What’s Next for Qatari Policy

Qatar is beginning to recognize a need to update its intellectual property laws, regulation, and enforcement to reflect best practices to support and protect innovation in an era of AI and other modern technologies.

Qatar will need to continue to pro-actively work with its close trade, security, and technology partner the United States on evolving national security concerns and actions, including on AI and export controls.

Qatar’s data governance strategy could benefit from more explicitly embracing an international dimension in terms of working with other countries on shared concerns. Qatar may consider joining the new Global Cross-Border Privacy Rules (CBPR) Forum. The Global CBPR Forum creates a space for legal jurisdictions, certification entities, and organizations handling personal data to come together around common data protection and privacy interests and build trust in cross-border flows of data. Thus far, it has 13 jurisdictions as members, including Australia, Japan, Mexico, the Philippines, and the United States. More countries are considering joining, including Bermuda, the Dubai International Financial Center, Mauritius, and the United Kingdom.

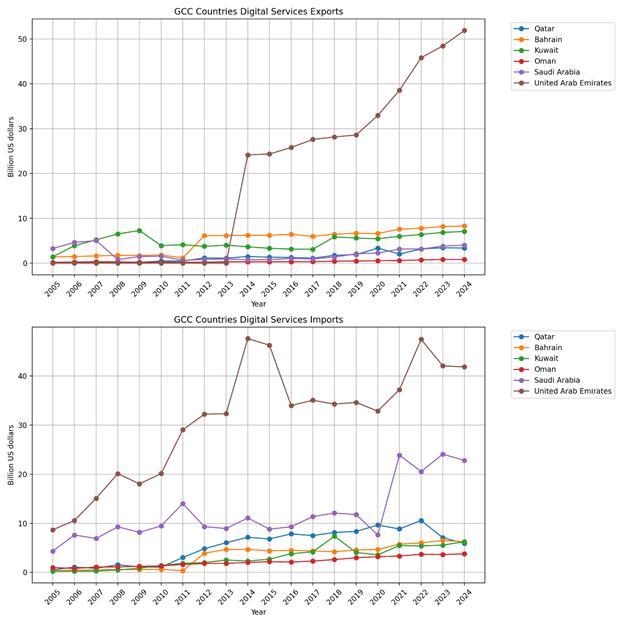

Qatar lacks a clearly defined regional and global digital trade strategy. As a smaller market with large investments in AI and digital infrastructure, inevitably it will need to target foreign markets to make these investments commercially successful. The GCC has yet to pursue an integrated regional digital economy framework akin to what the Association of South East Asian Nations (ASEAN) have done. Qatar and its GCC partners could emulate Singapore, the United Kingdom, and other leaders in doing this, but also pursue new digital trade and digital economy agreements with trading partners to ensure local firms have clear and open digital market access in the future. The data shows it has a lot of room for growth (figure 3).

Figure 3: Digital Trade in GCC Countries

Qatar currently lacks consistent, comprehensive, and comparable data to measure digital and technology policy issues. To its credit, Qatar has embraced open data, but the data it has on technology and digital use in the country is limited. Likewise, Qatar just launched the National Data and Statistics Strategy. However, it’s unclear whether it’ll include dedicated statistical efforts to measure and track Qatar’s digital economy. For example, whether it’ll setup satellite accounts like the U.S. Bureau of Economic Analysis had for the digital economy.

Most critically, given its economic significance, Qatar lacks data on technology adoption rates for email, cloud, AI, and other new digital services and technology. Qatar may explore how to develop all of the metrics that the Organization for Economic Cooperation and Development (OECD) tracks of its members, such as the share of businesses purchasing cloud services. Likewise, in lieu of developing new statistical measures, Qatar could pursue broad, representative surveys on key issues like AI adoption in firms, similar to this recent OECD study which surveyed enterprises across the Group of Seven (G7) countries and Brazil. Qatar could also partner with private firmsto analyze their proprietary data to help assess relevant digital jobs, employment, and skills in the country.

Conclusion: A lot of early promise

The outlook for Qatar’s digital development is promising. Qatar has moved early and laid a solid foundation. But it needs to keep it up and change as it increasingly moves from plans to action.

Firms will find a friendly partner in the Qatari government, but challenges remain in terms of navigating the rules around new and emerging technologies. It will require a partnership in terms of working with Qatari policymakers on what they want to achieve and the best way to do that. This will require firms to invest in education and capacity building for local stakeholders. It will require help in providing research, evidence, and benchmarks to shape and guide policy development. It will take concerted advocacy across various government ministries as many are developing their own plans under national strategies. Yes, as the maxim goes, where there’s a will there’s a way – and our engagements in Qatar have convinced us that the will to advance its digital strategies as a key component of its economic future is strong.

CGA is uniquely well positioned as a one-top shop to help firms in Qatar given it has the digital policy expertise, along with Crowell’s Doha office to help advise on market entry and compliance with local laws and regulations,